With JD Business Solutions, today we're going to go over how to fill out the tax form 1065. This form is for the income tax return for a partnership, whether it's a general partnership or an LLC with one or more people. For most of our audience, which consists of small businesses, it's likely that it's just you and your spouse, or you and your husband, or maybe you and a friend or business partner. If you have an LLC set up, you will need to file a form 1065. Before we start, I highly recommend hiring a qualified CPA to prepare this form for you. They will save you more money than you spend on them, nine times out of ten. If you have a good CPA, you could get yourself in trouble if you try to do this on your own. However, if you are brave enough to try it, and you have an idea of what you're doing, this guide will help you. If you still need assistance, just hire someone else to do it. Understanding the form will help you organize your documents and reduce the cost of someone preparing your tax return. With that being said, we are currently accepting new clients for this tax season. You can find more information on our website CPAJDBe.com, or you can email us at CPAJDBe@gmail.com. We offer various pricing packages and would be delighted to work with you. We work with clients from all over the country, so don't hesitate to reach out to us. However, please note that slots are limited, so contact us soon if you're interested. Alright, let's get started. We'll begin by going over the initial section. You need to input your principal business activity, using "My Business Tax Prep" as the name of...

Award-winning PDF software

1065-X Form: What You Should Know

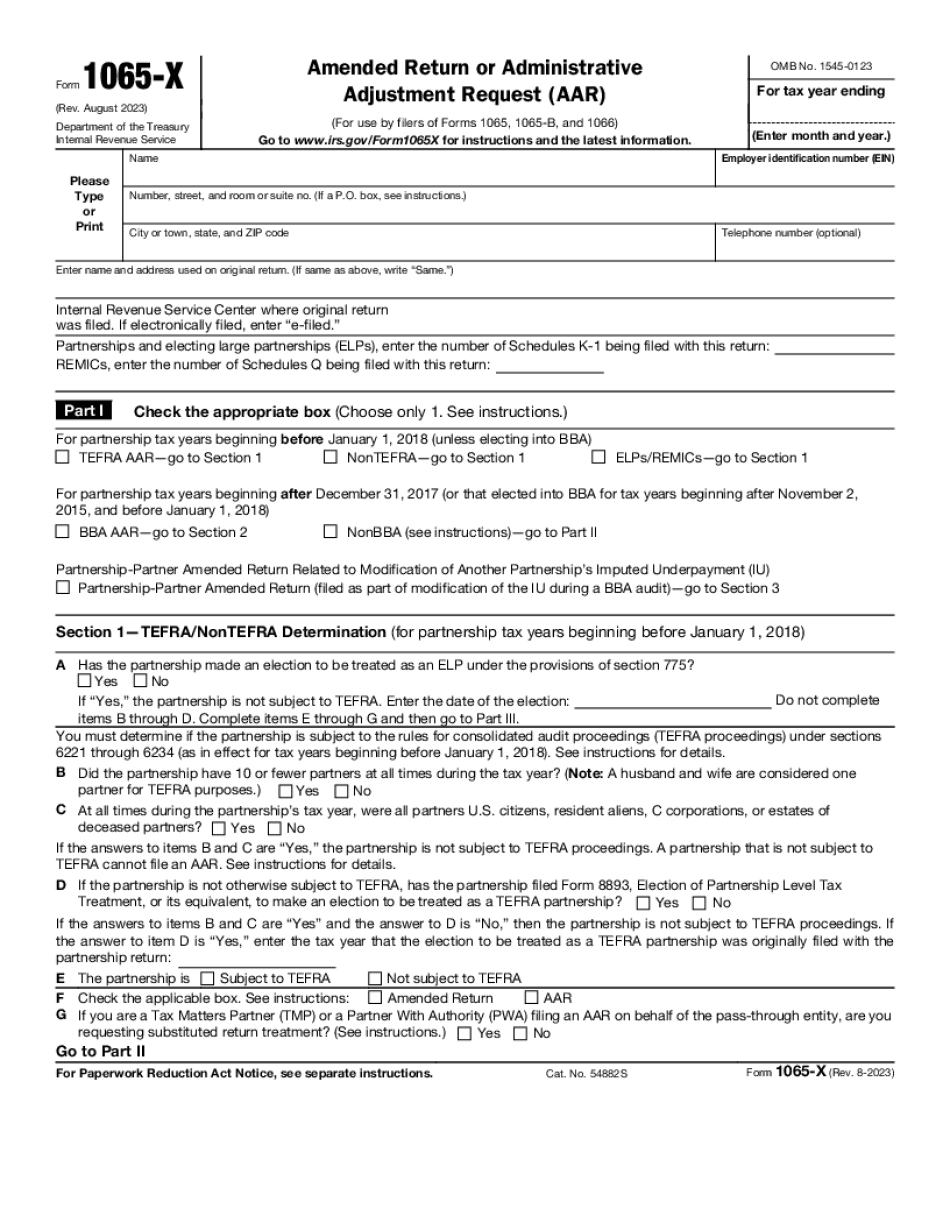

Form 1065X Form 1065X, Amended Return or Administrative Adjustment Request, is an amended return or administrative adjustment request from the individual partner or partner-sub-chapter entity reported on Form 1065, Schedule K-1. The form provides a form for partners at either the partner-sub-chapter entity or partner-partnership level. For example, partners at the partner-sub-chapter entity level are partners for taxable years ending January 1, 2010, or after April 3, 2020. Partners at the partner-partnership level are partner for taxable years ending What does the Form 1065X Form do? | Example Sep 7, 2025 – We are re-opening the form, this is the final day to file. Form 1065 Form or 1065X Form (or PDF) the IRS Form 1065 or 1065X is a paper form for partnership or partnership-subchapter S corporations or partnerships. This form is an amended U.S. form that is filed by a partnership or partnership-subchapter S corporation to report partnership income and deductions. This form must be filed by the taxpayer who reported the partnership income and deductions on a partnership return for taxable years up to Form 1065X is the form for reporting taxes, or the Form 1065X can be used for accounting. If you are filing Form 1065X to report U.S. income, this form is for reporting and collecting certain income tax; and for the payment of interest on U.S. tax debt. In addition, this form: Form is updated yearly Form 1065X-FB/FS, Tax Return or Annual Statement, is filed with the IRS. You can expect this form, Form 1065-X-FB/FS, to come out on the due date given on Schedule E Forms 1065X, 1065X-A, 1065X-A-PF, 1065X-B, 1065X-B-PF are updated yearly Form 1065X/EZ and 1066-X are updated yearly Form 1065 is updated regularly Form 1066-E is updated every year (unless earlier amended) Form 1065X/1066X and Form 1066-X/EZ and 1066-X/EPF are not modified Form 1065 is always filed.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065-X, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065-X online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065-X by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065-X from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 1065-X