Award-winning PDF software

Where to file 1065 Form: What You Should Know

The partnership's profit and loss statement is the most important financial record created by the partnership, so carefully review and complete it. You often need to gather more information from the partners before you can complete the partnership's final financial statement. Each partnership must prepare a final income and expenses statement and subsequent profit and loss statements for the partnership's year-end, including a profit and loss statement after the year-end. Also, each partnership must prepare an annual or interim balance sheet and statement of cash flows so that you can be sure you have sufficient cash on hand for the coming tax year. If you do not have the income or other financial documents needed for the partnership's financial statement, you can get the completed Form 1065 at the IRS Form 1065: Instructions — IRS Mar 22, 2025 — Form 1065 is not filing the partnership year-end financial statement. Use Form 1065 from the year past to complete the partnership's year-end financial statement. If you cannot get Form 1065 from the partnership, you must file each year-end financial statement separately. It's also important to include Form 1065 on your partnership's schedule of tax for each partner's taxation year of interest income. Mar 21, 2025 — IRS Form 1065 is not filed for the full tax year. Use Form 1065 from the year past to fill out Form 1065 and include it for each partner who did not file a form 1065. This is called an “as filed” filing, and may be more difficult to get. Mar 22, 2025 — IRS Forms 1065, 1065B and 1059 with Form SS-4 and Form 1059SA are not filed from the year past. Use Form 1065 from the year past. Use Form 1059SS-4 and Form 1059SA to complete Form 1065, but do not file it with the form 1065 or 1059SA. File Form 1065 and include it for each partner who did not file a form 1065. Make sure you have all information about your partnership income in order to fill out each form as effectively as possible. If you May not Have a Complete Return of Partnership Income When Filling Out Form 1065 for Partnership Year-End Financial Statements Feb 13, 2025 — The form 1065, U.S.

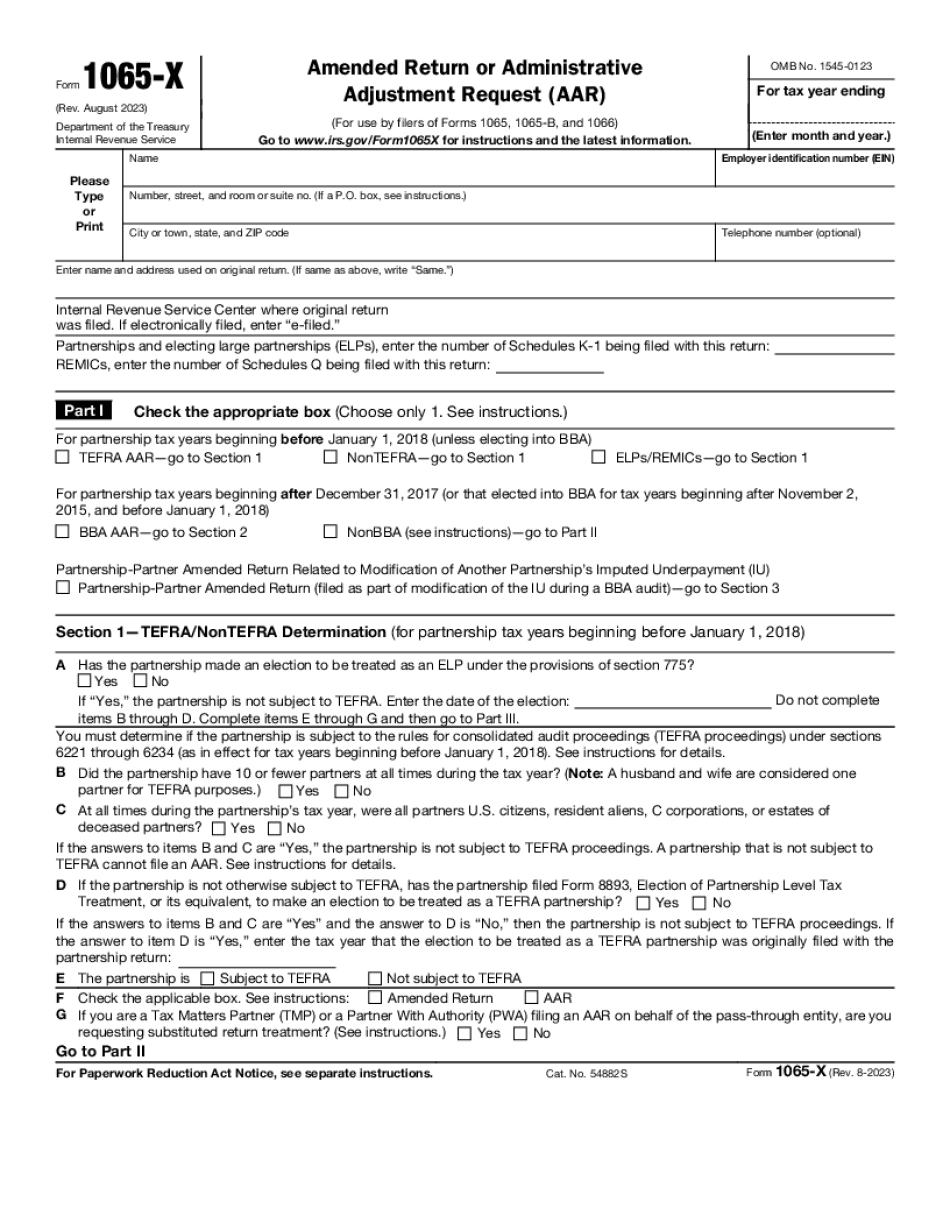

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065-X, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065-X online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065-X by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065-X from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.