Music, welcome to the office of the Treasurer and Tax Collector's annual business tax return 2018 filing video. This video provides a quick summary of the online form. Please review our online instructions and business tax code for detailed information. I also recommend watching our "What's New for 2018" video before you begin. - It's important to have all your business information available before you start. The letter you receive from our office has your 7-digit business account number and a character online pin. The online pin is formatted with both letters and numbers. You will also need the last four digits of your federal tax identification number. For sole proprietors, your federal tax ID is usually your social security number. - To begin, go to our home page at wwf.treasurer.org. Look for and select the "File Online Annual Business Tax Return 2018" link to access the landing page. The landing page contains important information, including the instructions and link to enter the filing. - When you're ready, enter the filing by clicking the "Annual Filing" button. Scroll down to the bottom of the screen and enter your seven-digit business account number, last four digits of your federal tax ID, and your character online pin. Then click on the "Save and Continue" button. - Once you've entered the filing, you'll see your business account number and links to the instructions, technical assistance, and a link to exit the filing across the top of the screen. You'll see chevrons that show the five major sections of the filing. On the bottom of the screen are buttons to navigate forward and back, as well as an image charting your progress. - The filing begins on page A1, business identification. There are two questions to answer for tax year 2018: Did the business have taxable business personal property...

Award-winning PDF software

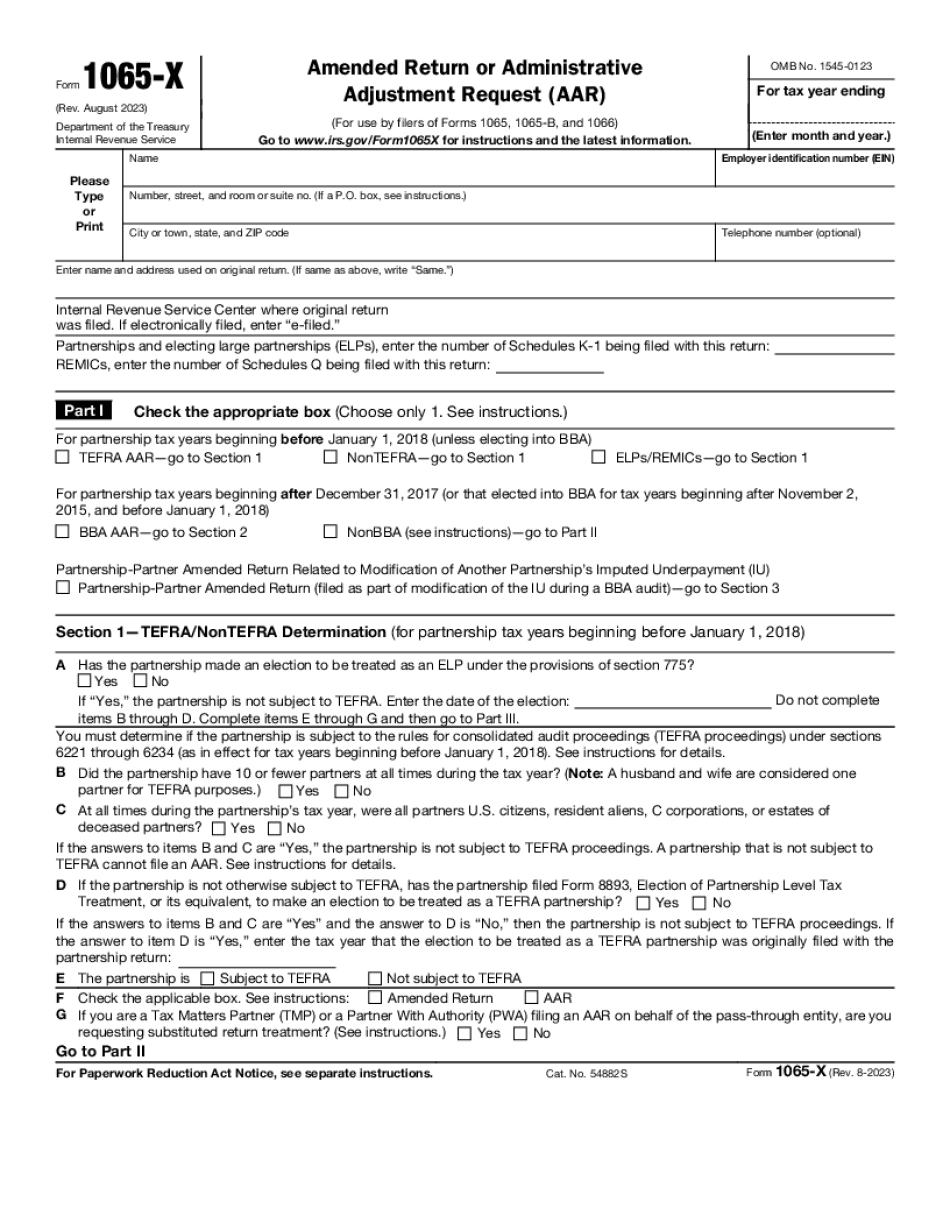

Amended return statement example 1065 Form: What You Should Know

For If you need to make changes to any part of Form 1065, you may need to file a Form 6020, Supplemental Return, or an amended return.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1065-X, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1065-X online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1065-X by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1065-X from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Amended return statement example 1065