Award-winning PDF software

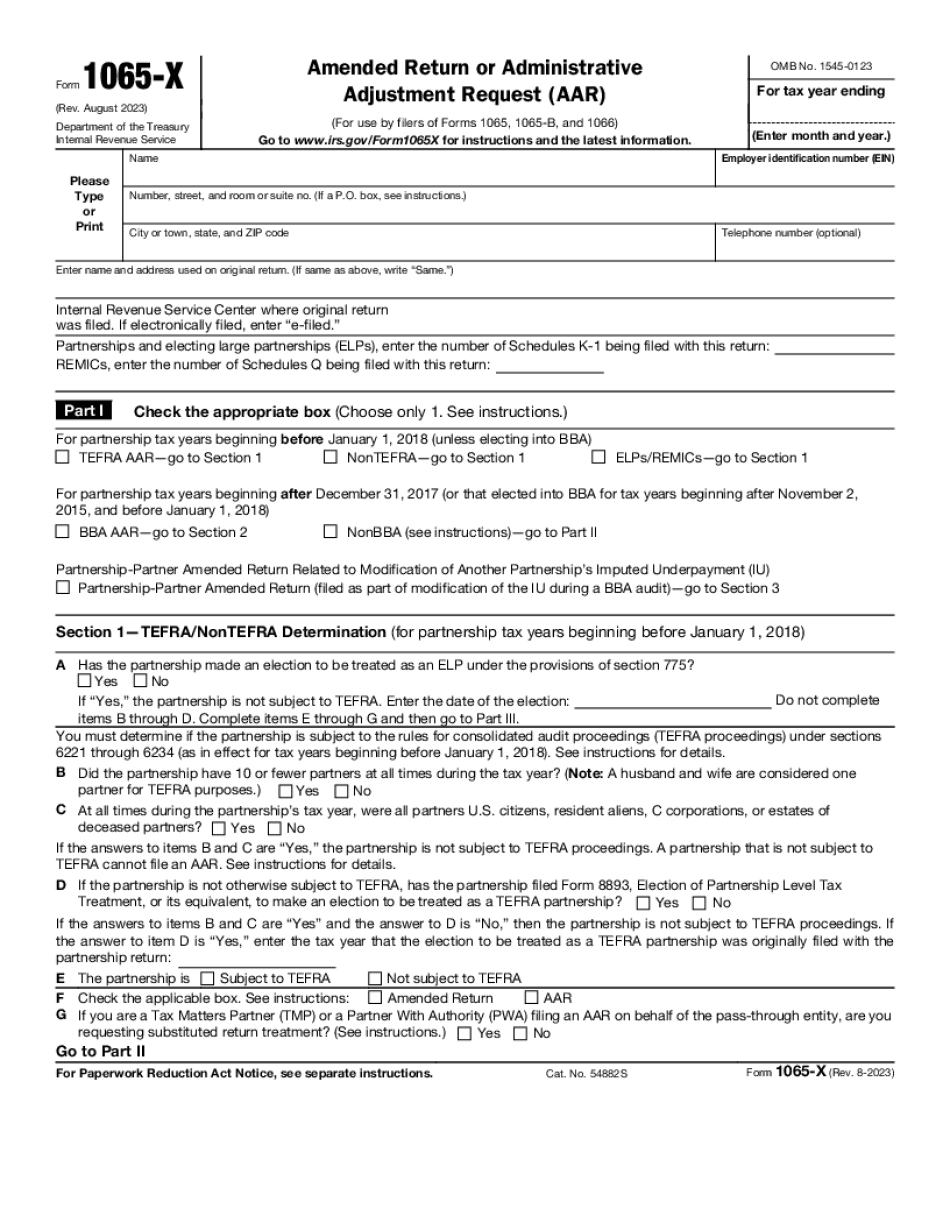

Cincinnati Ohio Form 1065-X: What You Should Know

R. Has had two choices to pay 90K (5%) income tax (or less) — 1. Or, 2. Donate 10.3%/12.5%/16% of Joe. R.s 90K income to a local organization, including, such as the Boys & Girls Club, Youth Center, Boys & Girls Club of Cincinnati, Charity Found at for a charitable contribution deduction. The Boys & Girls Club is very small, but they are the best option because this does not cost Joe. R and her family anything extra while they make their monthly commute to work! Taxes are based on one partner's income; so, if Joe. Rs income is 90K, each partner's income would be 30K; the tax of 10.3% (29.90) will be applied to both of them, with the remainder being applied to Joe. R's partner. (If Joe. Rs partner is earning just over 90k and (she/he) is in an IRA, her/him would receive no tax. If Joe. Rs partner is earning more than 90K, then she/he would pay taxes on both her/his partner's income.) You might consider a tax-deductible donation to a charity, such as the Boys & Girls Club. Form 1065-X Return — IRS Nov 25, 2025 — Amended return (Form 1065) is filed by the following partners: Joe. R., her husband, Mr. S., and Ms. H.S. Note: When the tax year ends, the spouses may switch partners. At the end of the tax year, the partners should file the new (amended) return. Nov 25, 2025 — Joe. R.'s partner files their joint return. Note: The return must be received by the IRS. (If you are having tax-related problems, contact your agent.) 1065-X — Where to File U.S. Return — Ohio In 2013, we received a large influx of returns, so due to the high volume of returns we receive we are no longer able to accept Form 1065-X. Please use the Form 1095-X or Form 1065W instead. Nov 24, 2025 — Joe. R.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Cincinnati Ohio Form 1065-X, keep away from glitches and furnish it inside a timely method:

How to complete a Cincinnati Ohio Form 1065-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Cincinnati Ohio Form 1065-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Cincinnati Ohio Form 1065-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.