Award-winning PDF software

Form 1065-X for Eugene Oregon: What You Should Know

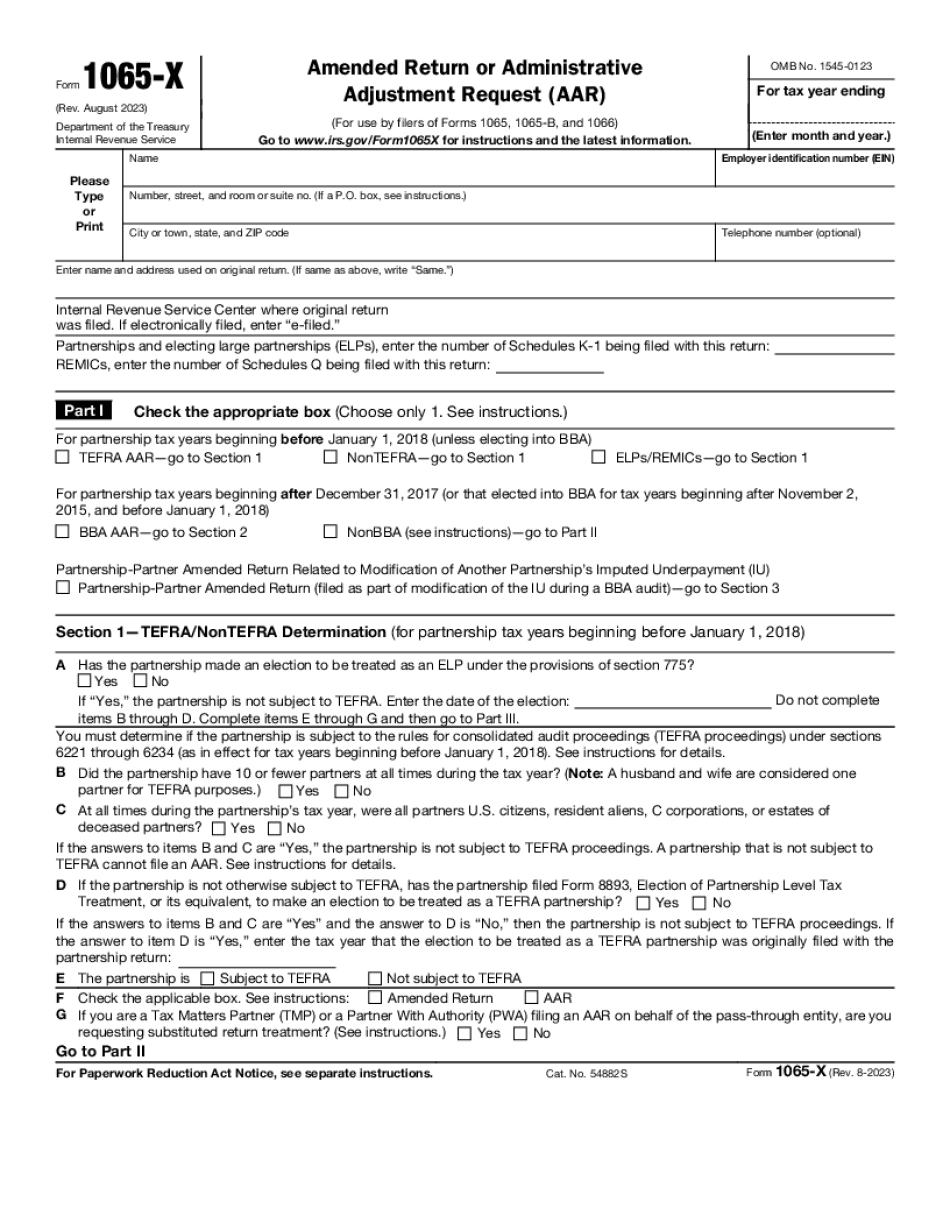

IRS Forms 1065-X are part of the Form W-4 form you receive. Taxpayers can report on 1065-X if someone else caused additional, corrected tax liability for the taxpayer(s). Forms 1065-X are also used by other businesses and non-profit organizations. In the last few years, businesses have used Form 944 to reduce the amount of taxes they owe or to claim refunds. Some businesses try to hide the source of an incorrect tax return through these means—that is, by claiming a failure to file on Form 944. Form 1065-X eliminates this fraud by reporting on the returned return the correct information. While this may save taxes, businesses must pay the proper amount of federal and state taxes, plus the correct tax to the state or local government. This form for business owners uses the most recent versions of IRS schedules and the IRS schedules on 1065-X. For additional instructions and a list of available templates, see The Forms (PDF) at IRS.gov. Form 1065-X is a “return” from the taxpayer or the business itself. An “amended return” from business owners is generally issued when the company does not maintain correct records, such as records showing whether it was taxed on its own business profits or its share of profits realized on the sale of taxable supplies. In some cases, Form 1065-X is also used as an initial step, or to correct information which would be reflected on a Form 944; or if a non-resident alien business owner needs to file a separate state return or claim a refund on his or her income. Business owners are eligible for a 1065-X notice if: • The error affected the owner; • The amount of tax owed was significantly higher or lower than the amount you were due; and • There was insufficient information to determine the correct tax.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-X for Eugene Oregon, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-X for Eugene Oregon?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-X for Eugene Oregon aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-X for Eugene Oregon from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.