Award-winning PDF software

Form 1065-X Irvine California: What You Should Know

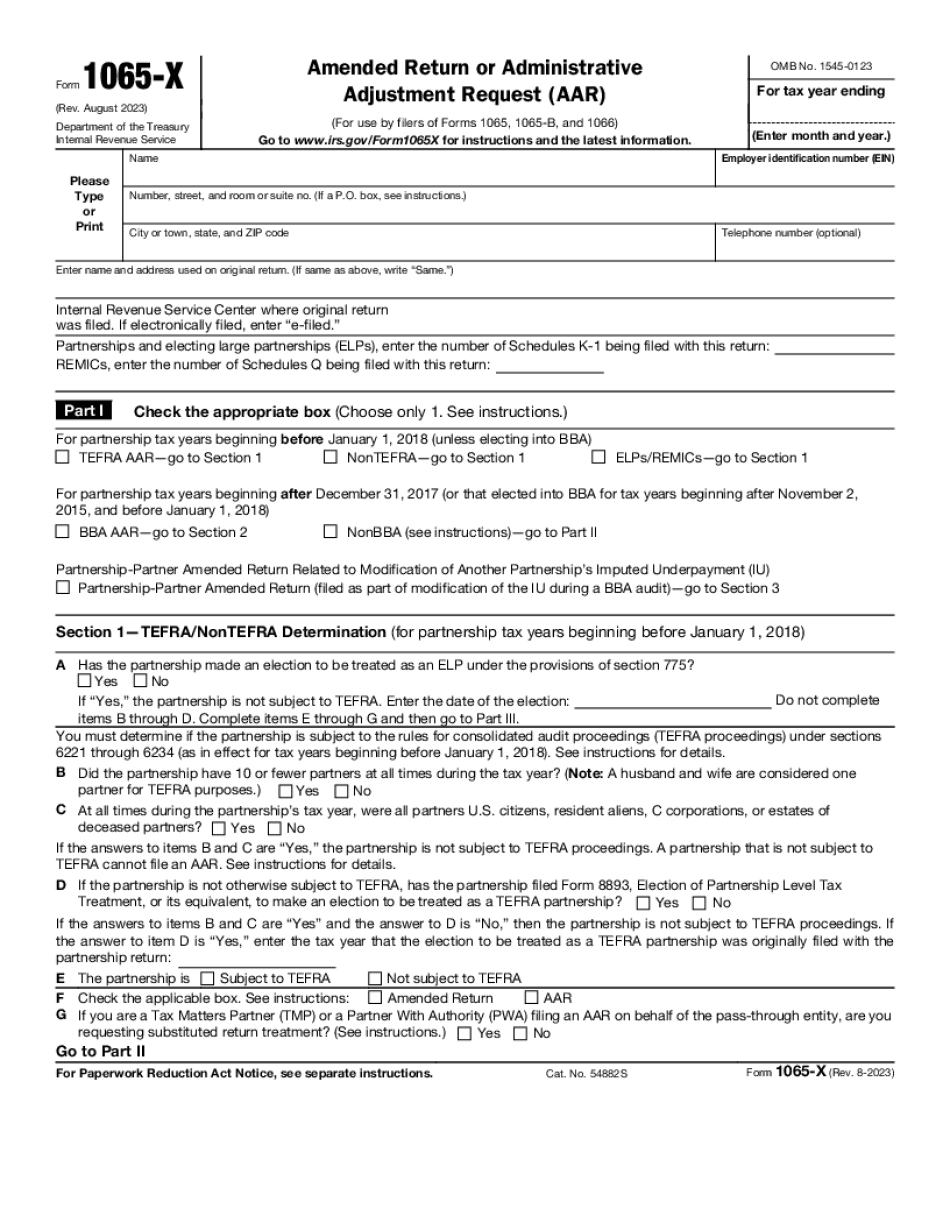

Tax Forms and Publications — Irvine — Crete Advisors Tax Forms and Publications — Irvine — Crete Advisors 11 Oct 2025 — Form 1065-X is an amendment to your return or an administrative adjustment request (AAR). The form specifies the date when the amended return of partnership income was filed and the amount you reported as income. You can file Form 1065-X electronically (see below), by mail, or in person at the IRS. File 1065-X by mail or in person | Download Form (PDF) 10 Sep 2025 — If an amended return was submitted and the form was approved by the Tax Center before this date, you can continue to use your Form 1065-X. If the form was not approved by the Tax Center before this date, you should update it to include information that was new for the tax year before you filed Form 1065-X. This is the case if you have changed the partner or designated individual on your original return. 10 Sep 2025 — If you submitted an amended return and the form was rejected, you need to get another copy of your form within 30 days. You should also use your 1065-X electronically. If you are filing for the first time, you only need to include the original return. If you were a partnership that filed its Form 1065 late, you need to file an amended return. 10 Sep 2025 — The Form 1065-X asks which type of return the partnership filing the return wants to file. The return should identify one of two types, either the partnership return or one of the partner returns. If you filed one of the partner returns, the Form 1065-X will ask you who the other partner is. If a partnership filed an individual partnership return only, the Form 1065-X will ask you what income and deductions were listed on that return. 10 Sep 2025 — The Form 1065-X asks where the information was recorded on file. If you need to update a filing, be sure to use your amended return to provide the information. 10 Sep 2025 — Because there is a limited number of return filers, the IRS will only process 1065-X's for partners whose return(s) are approved in more than 35 days. 10 Sep 2025 — When you file Form 1065-X online in the IRS Virtual Portal, you have the option of not using paper forms, or having your return sent to you by certified mail.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-X Irvine California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-X Irvine California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-X Irvine California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-X Irvine California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.