Award-winning PDF software

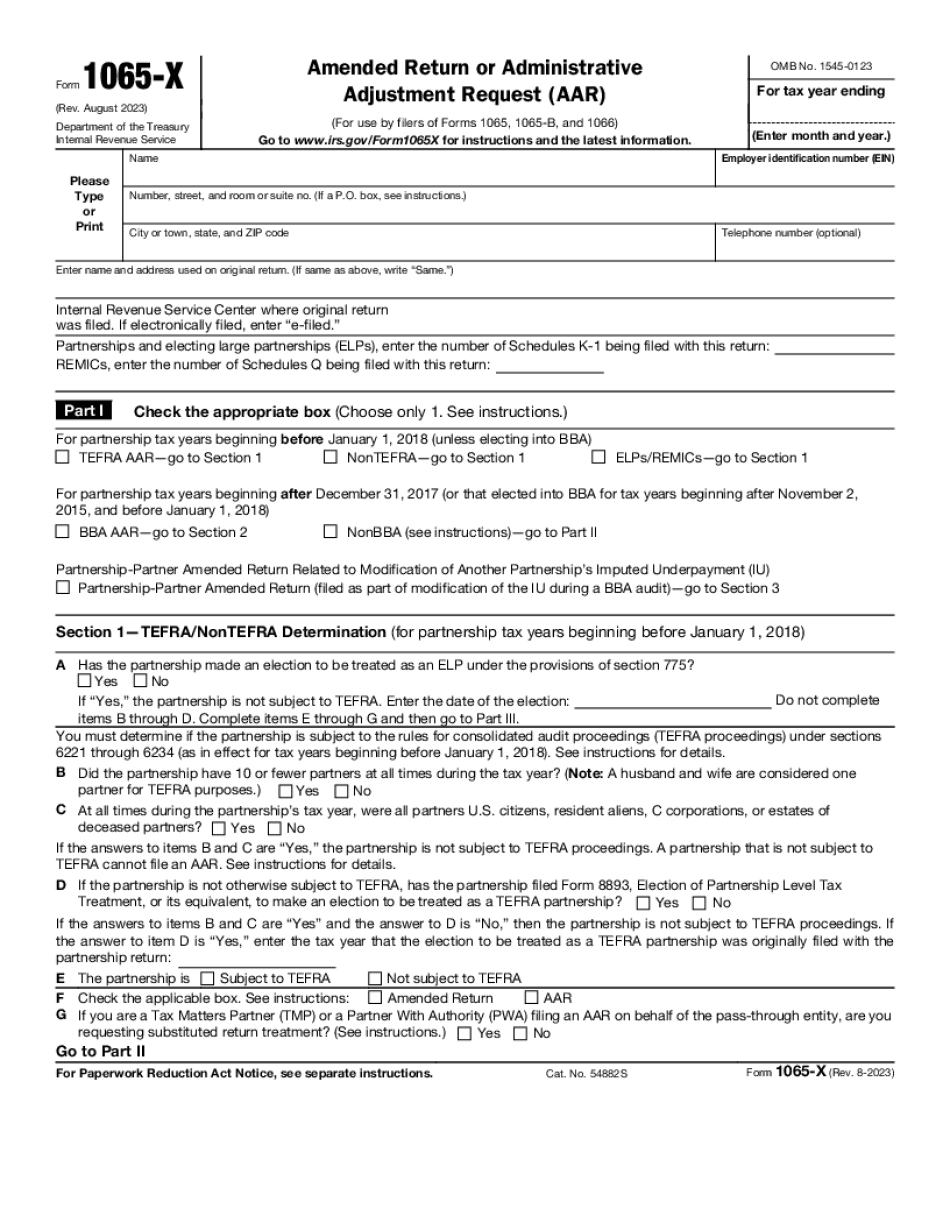

Form 1065-X Lowell Massachusetts: What You Should Know

See The Code of Ordinances, chapter 5, section 5:5, and Chapter 4, section 3, of The Trustees' Minutes, or for updated versions of these laws. A. A person who has entered into any partnership agreement of a corporation which has not been dissolved immediately after the agreement is consummated, as long as the corporation has not declared the dissolution thereof pursuant to Title 18, Chapter 69 of the General Laws, shall be treated as a nonresident by reason of the fact that such person is, at the time of such agreement, a nonresident and by reason of the fact that he has entered into the agreement. A. A person who has entered into an unincorporated joint venture, partnership agreement or trust agreement within this Commonwealth in lieu of the application of Title 9A, Section 26 of the General Laws, shall be treated as a nonresident by reason of the fact that the nonresident has entered into the agreement. In the case of an unincorporated joint venture, the term “member of the partnership” includes a partner and a noncorporate employee that is not a party to the contract under which the joint venture is formed. “Member of the partnership” does not include a partner and a noncorporate employee that is a party to such contract. “Member of the partnership” does include a partner and a noncorporate employee, or a partner and a partnership or business entity that is not a party to such contract. Dated at Lowell, Massachusetts on this 6th day of February, in the Year One Thousand Eight Hundred and Ninety-two. [signed] J. A. TURNER Income Tax Act of 1942, as amended, Appendix B This form is used when the taxpayer is filing an annual federal income tax return and has an amount not to exceed that shown in Schedule C to the return for the calendar year. P-1067 — Annual Tax Return Preparation and Electronic Signatures P-1140 — Annual Tax Return — Taxpayer Instructions and Related Documents P-1202 — Tax Information for Foreign Persons The following information is applicable to foreign persons who owe the Federal Income Tax to the United States. Foreign persons who do not file U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-X Lowell Massachusetts, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-X Lowell Massachusetts?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-X Lowell Massachusetts aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-X Lowell Massachusetts from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.