Award-winning PDF software

Form 1065-X online Bellevue Washington: What You Should Know

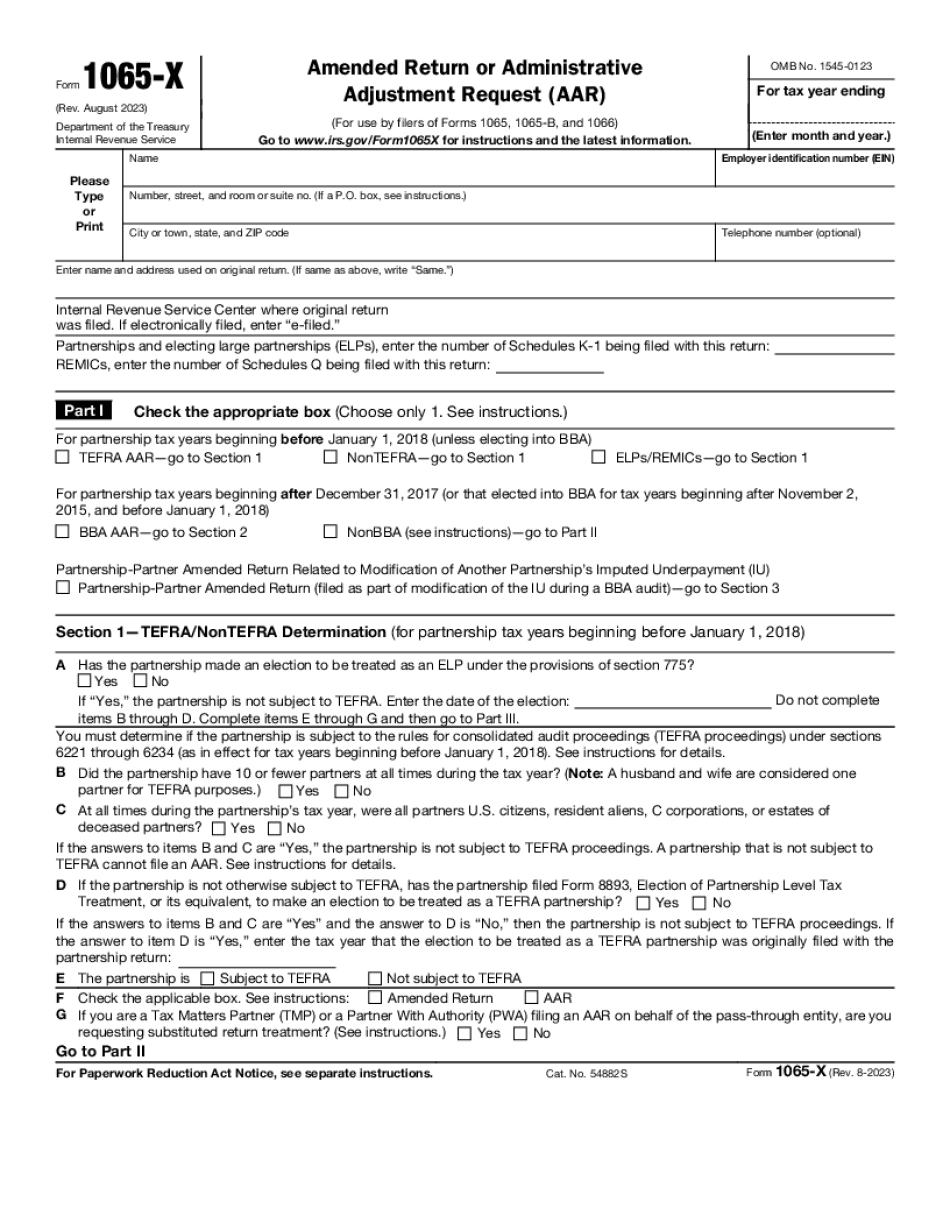

Amended Return or Administrative Adjustment Form that would result in both an amended business return and an administrative adjustment. Get a second look at a corrected return to see if there are any errors that might affect your business, family, or IRA. Make a request for an administrative adjustment to make corrections to a previously filed business return or administrative adjustment. 13 Apr 2025 — Forms 1065, 1065-E, and 1065-F are the two primary forms used by business owners to prepare and file their state and local income tax returns. For many taxpayers this provides time to complete the process and file their returns, but if you need some more time, use Form 1065-X. The purpose of this form is to give business owners extra time to find and correct errors on their returns. By using Form 1065-X your business owner can submit an amended return or administrative adjustment without having to go through the time-consuming process of filing the amended return or administrative adjustment and the necessary fees. It can also allow your organization to save some money on filing fees at the same time you are taking the time to adjust your business structure or business operations. The IRS has updated and improved upon the tax forms they already provide to taxpayers. With the increased complexity and cost, they are now offering a new and streamlined way to complete your tax return with much less hassle. If you are a small business owner, small taxpayer, or a taxpayer who is not sure which type of returns you currently file, we are available to help. If you are not sure what types of returns you need to file, call the office to talk with a specialist. How Can Form 1065-X Help Me? We all make mistakes. However, the chances of your business not filing properly or filing incorrect reports increase as the volume of your business increases. By filing Form 1065-X, you will reduce your chances of being caught by error with a simple change in filing requirements by filing Form 1065-X, which can be done online or with a paper copy. Your business may still file incorrectly, so filing 1065-X is a chance to make sure your tax returns are correct. In most cases, Form 1065-X should not be necessary, although it can be filed in the event of a situation where you know the business owner or any other family member may have made false or fraudulent statements. Many businesses fail to file their returns due to the increased number of calls we receive concerning these situations.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-X online Bellevue Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-X online Bellevue Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-X online Bellevue Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-X online Bellevue Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.