Award-winning PDF software

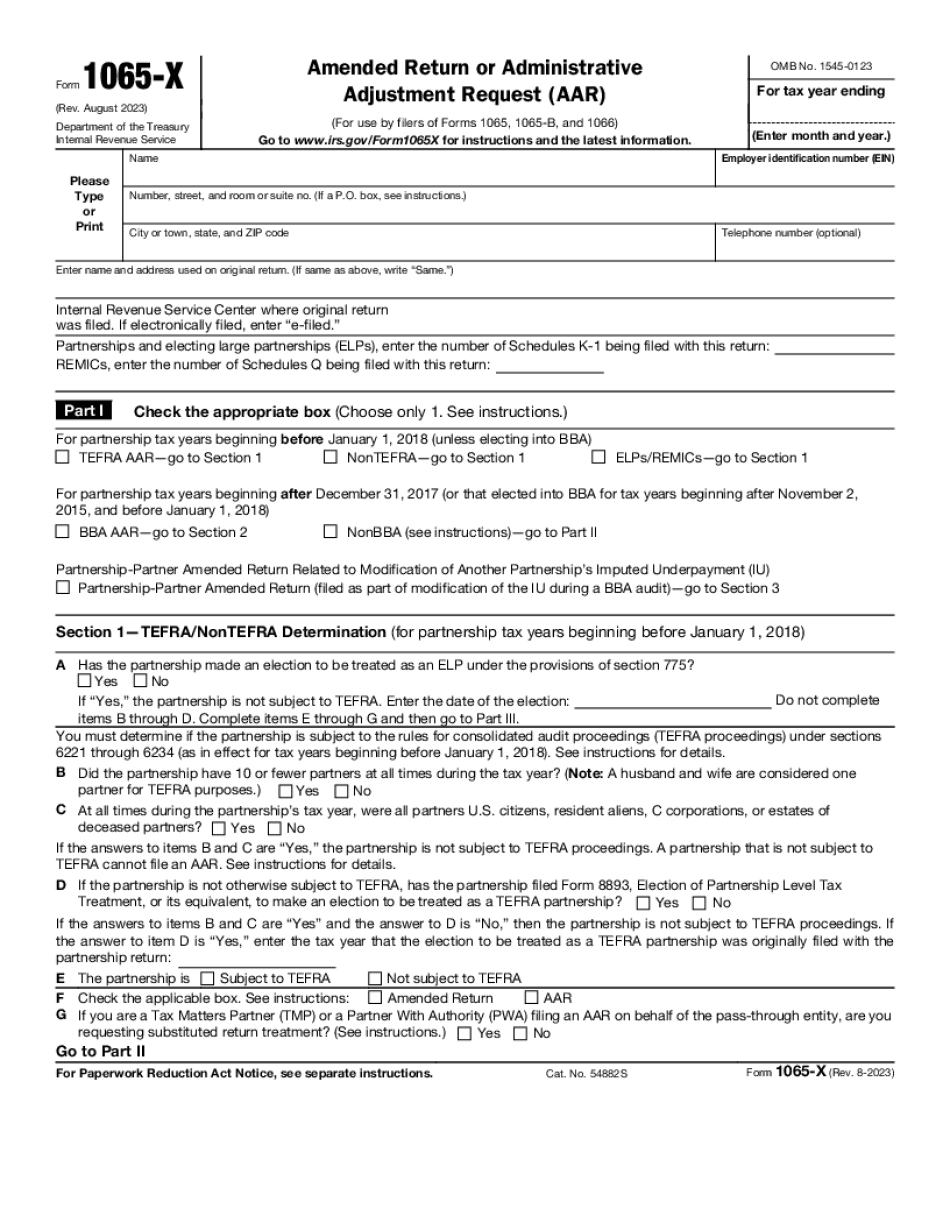

Form 1065-X Pearland Texas: What You Should Know

The property is fully fenced and fully furnished. A golf course, tennis courts, and volleyball court complete the amenities available. The community is located approximately 4 miles north of downtown San Antonio from US 281 on US 83. A golf cart can be reserved by calling A 1065 form can be requested by the partnership; this form must be signed and notarized and is signed by the partner listed on the form rather than by the partnership itself or the corporation. What is Form 1090-D? | Definition, Sections, & More Mar 1, 2025 — Form 1090-D is the annual report of a corporation required by section 902 of the Internal Revenue Code. This report is a certification of information provided by the corporation. C.I.R. Sec. 4.401(d) — “Any corporation which files or receives a form of return required under section 902 shall furnish to the Secretary such reports, forms, statements, and information as shall be prescribed. The Secretary may require, in order to carry out his duties under sections 705, 706, 902, and 903 of the Internal Revenue Code (Internal Revenue Code), such further reports, forms, statements, and information as he may deem necessary to effectuate the purposes of such sections.” Filing C&T Forms 1.1 or a C&T Statement Sep 7, 2025 — In the State of Texas, a C&T statement or C&T can be filed once a month with the C.I.R. Form 1064-C. In the event that not all information is provided in a C&T form, the following information is provided in all such cases as well: (1) The gross tax year ended prior to the date of the filing. (2) The total amount of all credits or refunds available to the taxpayer which have been claimed, or which are being claimed by the corporation; and These are called “qualifying refunds”. If you find incorrect amounts on your tax return, you can make adjustments on your tax return using the Internal Revenue Service (IRS) form 1098-K. The form will allow you to calculate the amount needed to correct your return and will also allow you to request to have an amended tax return filed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-X Pearland Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-X Pearland Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-X Pearland Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-X Pearland Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.