Award-winning PDF software

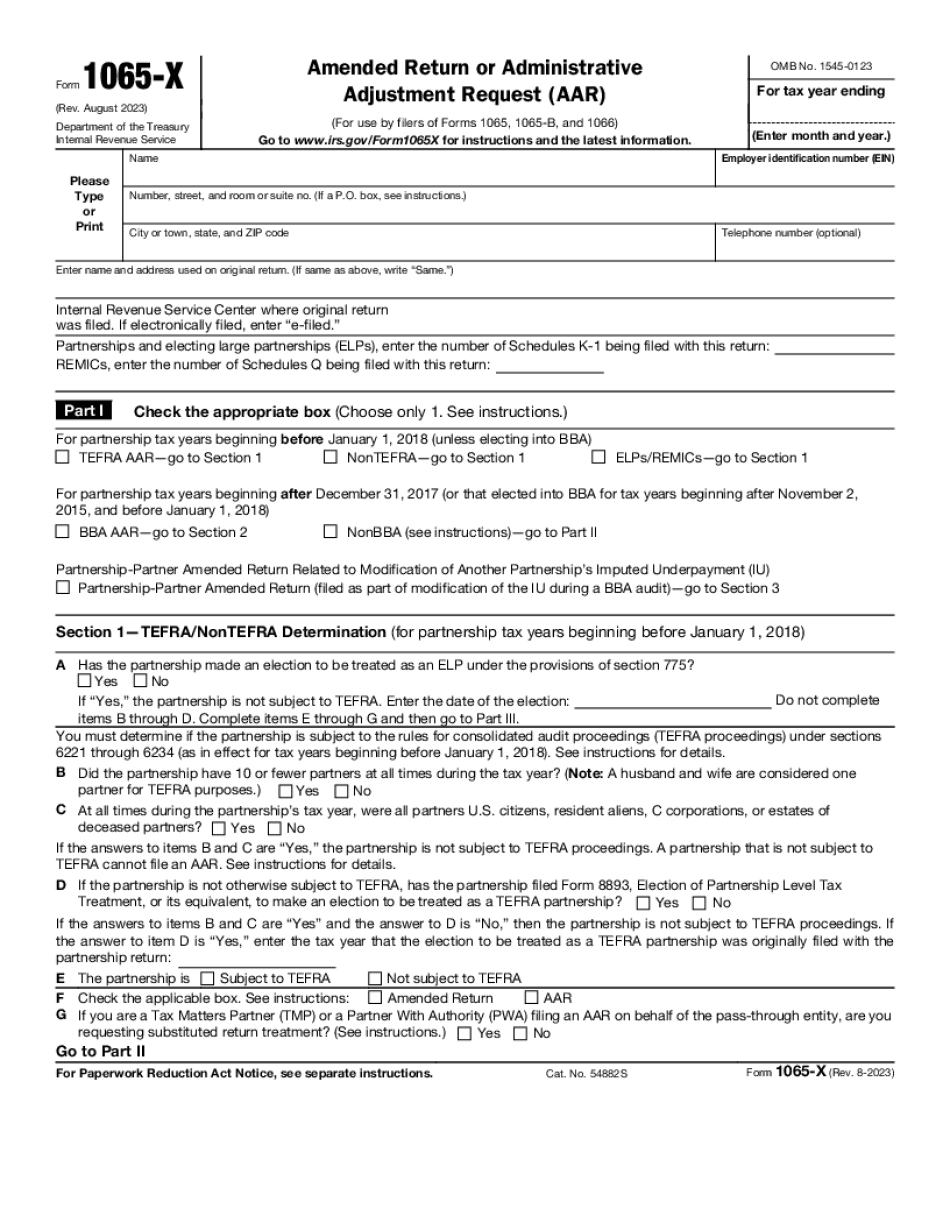

Mesa Arizona Form 1065-X: What You Should Know

Forms and Publications — Lloyd E. Kent, CPA The state must be aware that it is not required to have a new individual in place for a business that has been in existence for more than 90 days. After 90 days, a business must be in existence for at least one year before an owner can resign or the business can convert to a sole proprietorship. If that happens, the state may impose a waiting period, as long as it provides for a hearing or hearing is conducted. Form 1, Notice of Changes of Address Tax forms and publications — Lloyd E. Kent, CPA Effective January 1, 2016, the state may require that all new and amended tax returns be presented for filing as a single paper copy, and that the same paper copy not be submitted as a PDF or any other form. The tax return form for 2025 is available online here. Any amended or new return must be filed at the same location where the original return was filed. Form 7 (Annual or Other Information), Certification of Compliance Tax forms and publications — Lloyd E. Kent, CPA A form which must be used by the state in connection with its administration of its tax program. Form 14, Registration of Partnership Publication. There must be at least one registered partnership in Arizona who is active for more than 183 days in the year preceding April 1, and at least one certified partnership for at least 365 days beginning April 1st. Form 1065 (Schedules), Application for Certificate of Exemption, Tax-Exempt Status by a Qualified Small Business, Tax-Exempt Status by a Qualified Partnership for Small Businesses. Publication. There must be three or more registered small partnerships or qualified partnerships active for at least 180 days in the year preceding April 1. Form 34, Annual Report, and Form 33, Certification of Quarterly Report Yearly report. A quarterly report must be filed with the IRS every three months. Form 34 is generally used for real property transactions rather than partnerships. Form 33 is for partnerships and/or small businesses in which income is reported quarterly. Form 4 (Awards), Annual Reports and Certification of Payments of Claims and Rewards to the State of Arizona and Certain Related Agencies Form 4 returns must be filed if the state has an appropriation of state funds by law. Form 1a is also required to be filed. The annual report form should be completed and submitted by March 1.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Mesa Arizona Form 1065-X, keep away from glitches and furnish it inside a timely method:

How to complete a Mesa Arizona Form 1065-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Mesa Arizona Form 1065-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Mesa Arizona Form 1065-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.