Award-winning PDF software

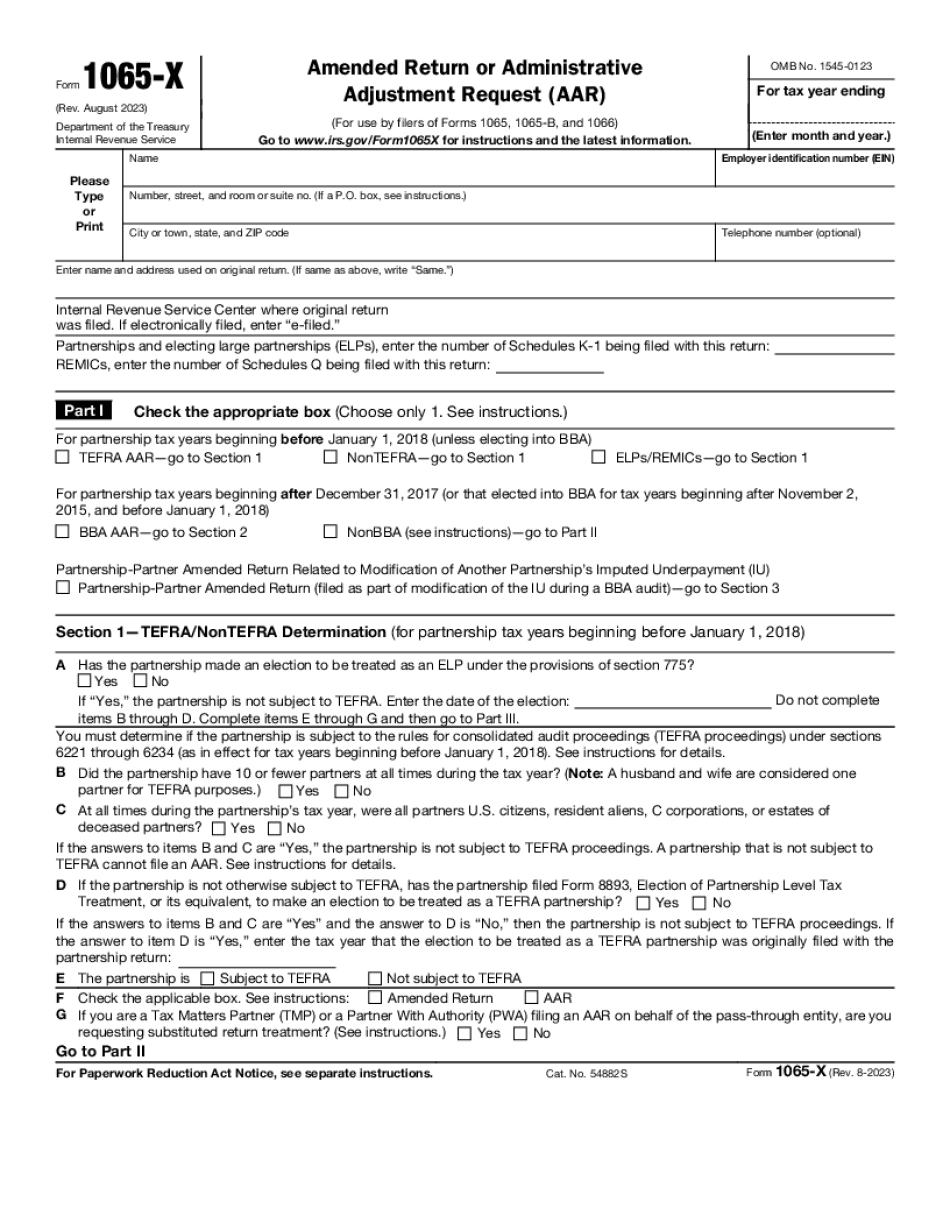

Printable Form 1065-X Sugar Land Texas: What You Should Know

If the form contains supporting documentation, it must be uploaded and completed in the appropriate location. Also, if the IRS determines that the return did not provide sufficient supporting evidence that the taxpayer is entitled to an abatement or waiver that would have been allowed, you must return the entire return with all supporting documentation by the close of the 10th day of the month following the month the return was filed. For more information on how to file electronically see How To File electronically. Forms and documents that are required to be provided in support of a taxpayer's request for a tax return reduction. These also include certain records and receipts that provide proof of property tax abatement or a tax liability reduction. Documentary Requirements If you are an individual seeking a tax return reduction from the Division of Property and Casualty Claims or State Tax Commission, you must provide documentary evidence (such as a Certificate of Exemption, Affidavit of Occupancy, or a Copy of an Application for Reductions or Waivers) for at least two out of the three years immediately preceding the filing of the return. The requirement applies regardless of whether the reduction is on account of property taxes or some other type of tax or penalty. If the request is on account of property taxes, the document must be accompanied by: 1. Proof of payment of the property taxes. 2. One copy each of the following (if applicable) (1) Affidavit of occupancy for each dwelling, mobile home, and trailer that you occupied that were assigned the property tax reduction that you are requesting. (2) One copy of the notice of reduction you requested. (3) One copy of any other documents that the seller gave you with the sale of the property that reduced the property taxes as claimed in the reduction application. (4) If you are claiming a tax reduction using an Affidavit of Occupancy for each dwelling, mobile home, and trailer that you occupied that were assigned the property tax reduction that you are requesting, provide a certificate that shows the date of the sale or the title document that shows the date of the assignment. The certificate should be signed by the property manager or other related person. If you are claiming a tax reduction using a Notice of Reductions, provide a copy of the notice.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form 1065-X Sugar Land Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form 1065-X Sugar Land Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form 1065-X Sugar Land Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form 1065-X Sugar Land Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.