Award-winning PDF software

Thousand Oaks California online Form 1065-X: What You Should Know

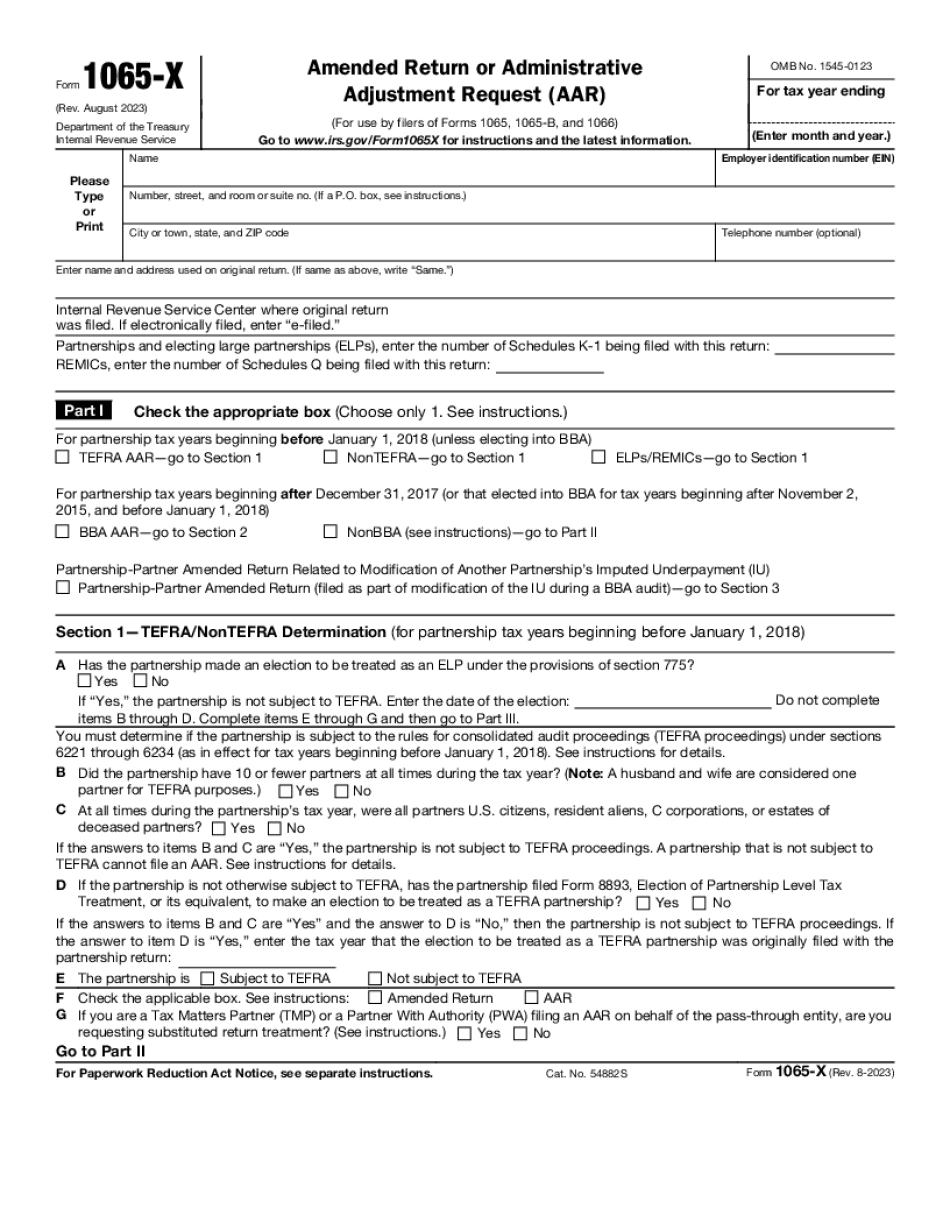

You can add food & beverages to your order and pick up on the way to the restaurant, or on the way home. Just call for details. H&R Block Tax Prep, LLC For your convenience, we provide you with a wide range of services for your tax needs, from preparing taxes for your business to preparing taxes for individuals. Whether you need only your estimated 2025 taxes for next year, preparing taxes for your business in 2018, or preparing taxes for your family business this year, H&R Block Tax Prep can help you. H&R Block tax preparation service for sole proprietorship 5 — IRS The IRS is expanding its eligibility criteria for its 2025 Tax Deduction and Amortization Rules Qualification. Sole proprietorship will now be considered an income class for the purposes of the deduction and amortization rules, which will make them eligible for the maximum allowable deduction. Amendment to Schedule C to reflect noncorporate income 3 — Internal Revenue Code — IRS Jan 13, 2025 — Form 1065 Amended Return or Administrative. If your business had earnings from activities in excess of 200,000 reported as gross income on Form 1041 and you received an extension of time to prepare or file your return because of the hurricanes, you may be able to apply the extension to the 2025 tax return for the 2025 calendar year. If you are an individual with total income of over 250,000 and make over 200,000 in net business income from a small business, this extension will cover more of the earnings. Sep 18, 2025 Update on the extensions for the 2025 tax year 3 — IRS Sep 18, 2025 — Form 1065-X, Application for Extension of Time To File or Filing Deadlines. H&R Block Tax Prep, LLC, can provide extensions of time to file if one or more of your income tax returns for a previous year were filed after December 31st, 2025 and if you had extensions requested but did not receive them and had a return due in the calendar year. Our tax pros can contact you on the phone to discuss the extension option and answer any questions you may have. Form 1095-EZ Return of Exempt Organization — IRS Sep 25, 2025 — Form 1095-EZ Return of Exempt Organization. If you have previously filed a Form 1095-EZ, you must file a new Form 1095-EZ and provide the new document to your Employer.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Thousand Oaks California online Form 1065-X, keep away from glitches and furnish it inside a timely method:

How to complete a Thousand Oaks California online Form 1065-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Thousand Oaks California online Form 1065-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Thousand Oaks California online Form 1065-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.