Award-winning PDF software

Form 1065-X Everett Washington: What You Should Know

Everett, Lake Stevens (Snoqualmie, Lake Washington), and Snohomish County. The District includes parts of Kit sap and Lewis County (including the Port of Everett and the Port of Snohomish County), as well as Clark County (including Lake Whitman), Duvall (including Duvall Bay), and many small island communities. There are no city limits. In early 2018, the Washington State Legislature passed a transportation tax (SB 5206, Assembly Bill 5066). This tax increases the gasoline excise tax by 32 cents per gallon from 3.50 to 3.58 per gallon effective Jan. 1, 2018. As many drivers in Washington now use only diesel fuel, the tax is an important money-saver for Washington car owners. As part of the Senate Bill 5206, the Department of Transportation is required to issue a new rule changing the definition of a taxicab and exempting some taxicab companies from their requirement to operate a Taxicab Service Company. However, in January 2025 the Department of Transportation, along with other state agencies, began accepting and accepting a request to change the definition of a taxicab to accommodate a transportation tax. Because of the nature of this process, and the many years that have passed since the Department adopted new tax definitions, the Department is not able to provide further details on the status of the rule change rule. For more information, e-mail the DNR at, or call. DNR's rule change is the subject of a lawsuit filed in King County Superior Court by one of their customers. You can read a copy of the complaint here. To learn more, click here. The Washington State House of Representatives voted to make the property tax deduction more difficult to claim. The plan was put forward in an omnibus tax bill (HE 1051) which passed the House overwhelmingly. The plan will affect property owners in the state, who are required to itemize in order to receive a tax benefit. The bill also will exempt certain types of state agencies from the rule that will make it more difficult to claim itemized deductions. The bill will also increase the state portion of the sales taxes that the homebuyers of a home in the state are required to pay on purchases over 450,000. To learn more, click here.

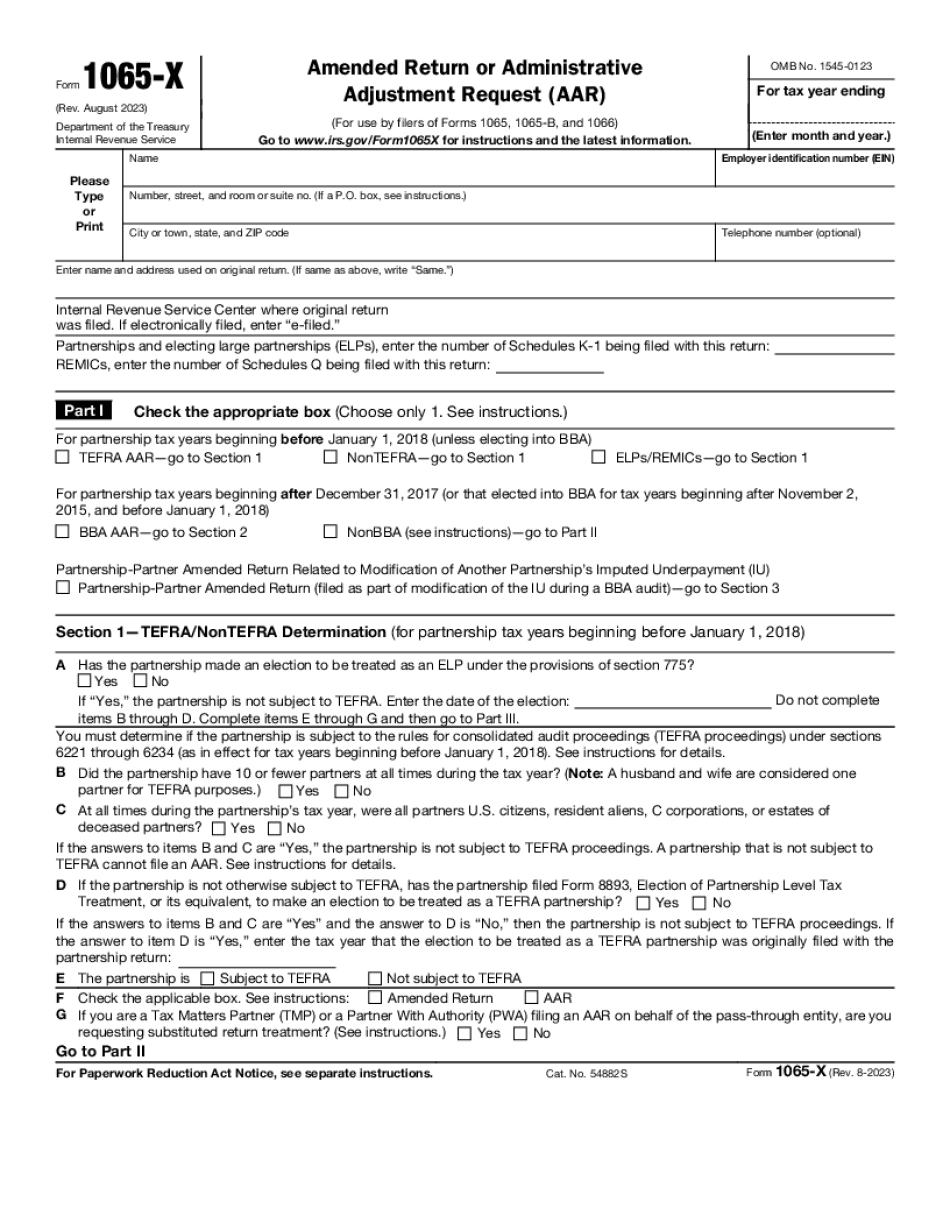

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-X Everett Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-X Everett Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-X Everett Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-X Everett Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.