Award-winning PDF software

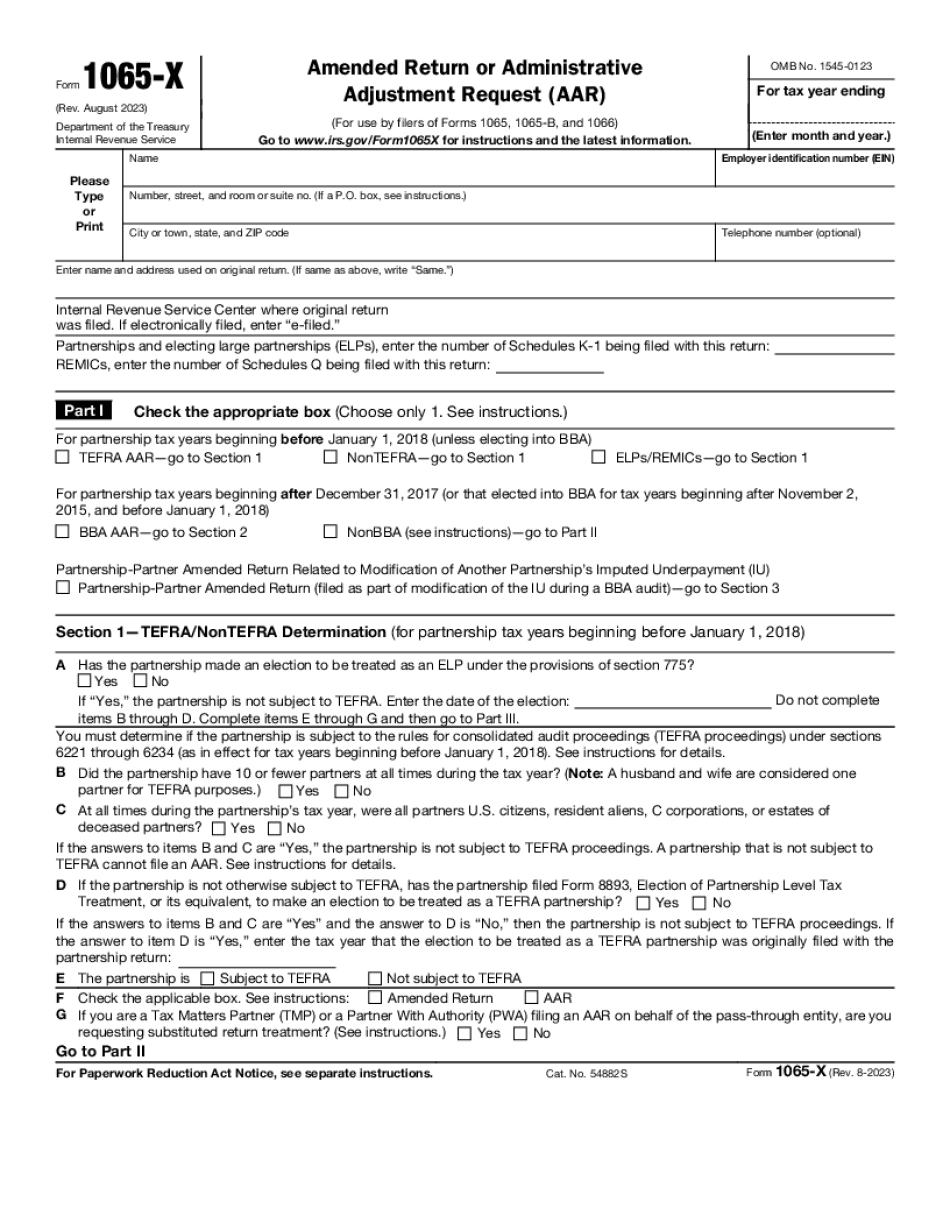

Form 1065-X for Stamford Connecticut: What You Should Know

An entity must submit its quarterly financial statements by this date to report its estimated income tax for the financial statements. Do not send Form 1065-X to the Department of Revenue. If you do, any errors in the summary will show an incorrect deduction and payment is incorrect.) Form 8951-K/SS — U.S. Bankruptcy Tax Return Form 8951-K, U.S. Bankruptcy Individual Income Tax Return — If you are an entity; you will receive Form 8951-K. Complete and file the forms along with other forms and supporting documentation to complete and file: Form 8951. K(1) or Form 8951-K(2) To amend or supplement the tax return, you must file Form 8951-K or file by mail, or submit any statement, statement in lieu of return, and any other information required in the Tax Code. Form 8951-K provides an option to file the return by mail, and you will not be required to pay filing fees. The requirement for paying the filing fees on Form 8951 will not apply if you file in person at the CT Treasury. If you file by mail, you will be required to submit the entire tax return (including all attachments) with your request. The return is available on CT-1040X, a Schedule K, which can be accessed by following the instructions on the form. You may also print or have Form 8951-K faxed to you. You may have to pay additional filing fees or postage. If filing by mail, the amount you pay depends upon the amount required to amend or supplement your return. The filing fee for each return is determined by the amount necessary to modify (except to correct) errors or corrections in the return, the total amount of your corrections, the size of your return, and a general assessment. A general assessment may be imposed to recover additional expenses that have not been considered in the filing of your return. You will be liable for any additional costs required to correct your return (including any costs that the government or your state may have incurred in response to a request). The amount of the general assessment depends on the circumstances and cannot be recovered from you. If you disagree with the assessment or claim you were wrongly assessed, appeal the assessment to the Connecticut Tax Commission. If you file Form 8951-K (or another Form) (any other form), the IRS will send you a receipt for your payment.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1065-X for Stamford Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1065-X for Stamford Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1065-X for Stamford Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1065-X for Stamford Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.