Award-winning PDF software

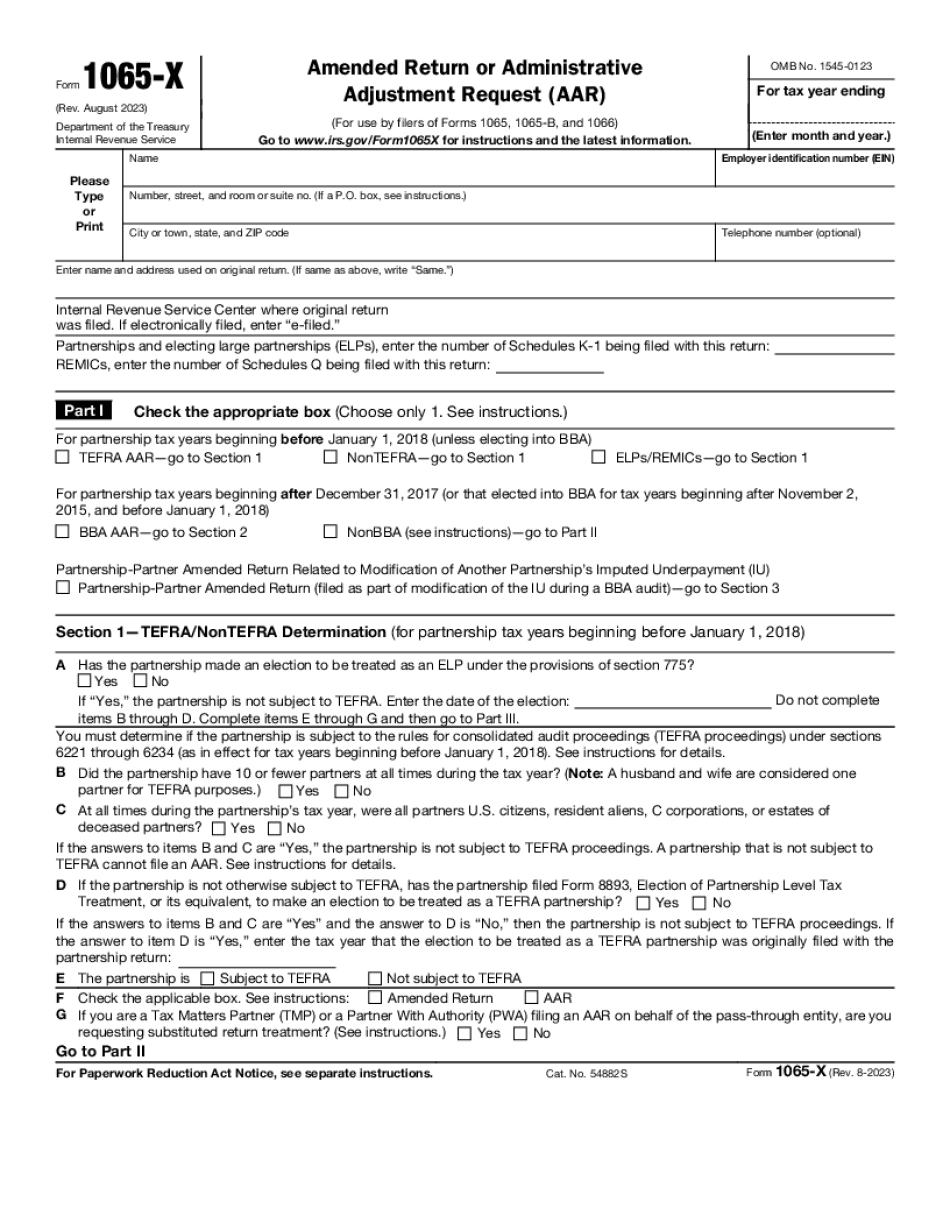

Victorville California online Form 1065-X: What You Should Know

The return also lists itemized deductions and the tax required for each, along with the basis for each of these deductions. Tax-Free Treatment—Gain or Loss All items on your form must be determined using GA Code, which is the same type of tax code in all 50 states and the District of Columbia. You must consider GA income tax when determining your gain or loss from the disposition of property (see our information about the different types of sales or sales-type transactions). The GA Code states each type of sale or transfer: Sale — a transfer in which neither the seller, nor any of the buyer's spouse or minor children, (unless there is no tax liability due under GA Code), is taxed on the transfer; the sale is subject to tax, and the buyer must pay tax Transfer of stock or notes from an individual to an individual member of a class, trust, company or corporation, regardless of whether the transfer is a taxable sale; the sale is subject to tax at the least of the seller's or stockholder's tax rate (usually 28%), or at the same rate as you might pay under GA Code if you owned the stock or notes, subject to some state tax law In addition to GA Code, items on your Schedule D form are taxable. Items that are exempt from tax include certain amounts that relate to Social Security payments, income from long-term care insurance payments or other income that is exempt from taxation under GA Code. All items on the Schedule D are subject to the tax, even if the amount of the transaction is less than the capital gain or loss limit under GA Code, as long as there is a source of income other than your sale. The seller of that item is legally required to include that amount on the Schedule D, even though the sale of the property was made without your having to pay taxes on the transaction. As long as GA Code is available, the IRS requires you to treat your gain as a capital gain when you sell real property you own and there is any gain with respect to those assets from other sources. If the seller doesn't use GA Code, your gain is a taxable gift or estate tax return item.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Victorville California online Form 1065-X, keep away from glitches and furnish it inside a timely method:

How to complete a Victorville California online Form 1065-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Victorville California online Form 1065-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Victorville California online Form 1065-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.